How to Avoid Scams When Selling Gold: A Seller’s Guide

Date of Published: November 11, 2025

Table of Contents

- Introduction

- Understanding the Risks

- Choosing Verified Gold Buyers

- Safe Gold Valuation Methods

- How to Identify Fake Gold Buyers

- Safe Gold Selling Tips

- Tracking Gold Prices and Market Trends

- Is Now the Right Time to Sell

- Final Thoughts

Selling gold is a financial decision that must be approached with clarity and confidence. With increasing reports of gold selling scams in India, sellers need a clear understanding of how valuation works, how to identify credible buyers and what precautions can ensure a safe experience. When supported by transparent testing and accurate information, gold selling becomes a predictable and trustworthy process. Following essential safe gold selling tips helps protect your asset while ensuring you receive its rightful value.

Understanding the Risks

Many scams target sellers who are unfamiliar with gold evaluation methods. These situations often begin with hidden purity checks, unclear price explanations or verbal offers that sound attractive but lack written backing. When a buyer refuses to show the testing process or avoids explaining how the value is calculated, the risk automatically increases. These conditions are the most common contributors to gold selling scams in India, and recognising them early can prevent significant financial loss.

Even small details matter. For example, if the buyer avoids turning on the display screen during purity testing or uses manual scales without verification, the chances of under valuation increase. A trustworthy centre will always ensure the seller can see the readings clearly, understand them and confirm them before any price is discussed. In gold selling, visibility is safety.

Choosing Verified Gold Buyers

The safest way to avoid uncertainty is to choose verified gold buyers who follow standardised, transparent procedures. Trusted gold buyers in India maintain clear communication, answer questions directly and ensure that every reading is visible to the seller. They rely on structured methods rather than offering inflated prices to attract customers.

This level of consistency is why many sellers prefer experienced and long standing centres. When a centre has been in service for years, it indicates operational stability and reliable processes. Networks with strong reputations, such as Value Gold, maintain procedures that are designed to protect the seller at every step, ensuring that the valuation remains accurate and fully understood.

Safe Gold Valuation Methods

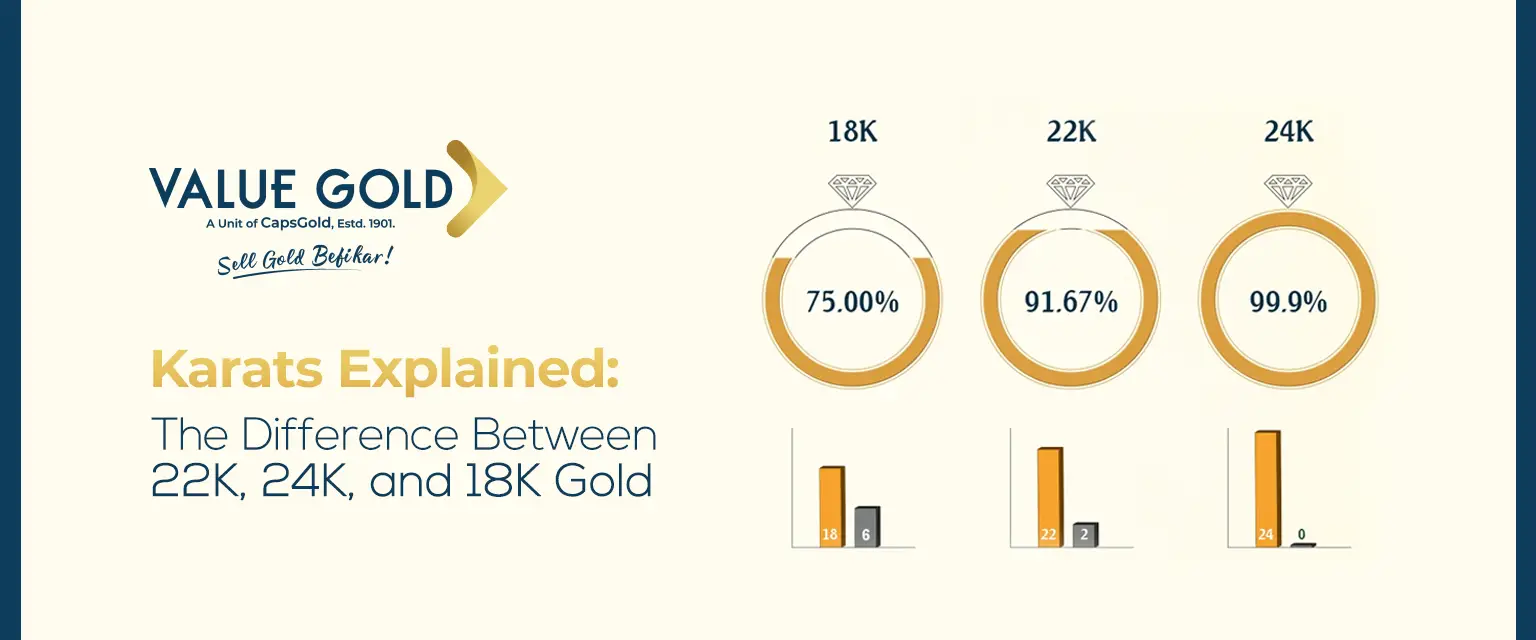

Accurate pricing depends entirely on the quality and transparency of the testing method. Centres that follow safe gold valuation methods rely on technology such as XRF purity testing, digital weighing and surface cleaning for accurate readings. These tools provide precise, tamper free results that cannot be altered manually.

If melting is required, reputable buyers perform it in clear view of the seller. This ensures that the final purity reading is based on visible, verifiable steps rather than assumptions. Technology driven evaluation also helps prevent manipulation and keeps the process consistent regardless of the type or age of the gold.

A safe valuation should leave the seller with no questions about how the final price was calculated. Every step, from cleaning to weighing to purity analysis, must be presented openly so the seller can make an informed decision.

How to Identify Fake Gold Buyers

Fake or unreliable buyers often present themselves as legitimate, but simple signs can help you recognise them. These include:

• Testing carried out away from your presence

• No clear explanation of purity readings

• No written receipts or documentation

• Prices not connected to daily gold rates

• No traceable history as an old gold buying company

A genuine buyer ensures that the seller participates in the evaluation and understands the results. They avoid vague explanations and always provide documents that confirm the final price. When any of these elements are missing, the risk of under valuation increases.

Safe Gold Selling Tips

The selling experience becomes safer when you follow a few essential safe gold selling tips.

• Check current gold rates from reliable sources before visiting any buyer

• Carry any available purchase bills or documents to support details

• Ask the buyer to explain every reading and ensure you can see the display

• Confirm that final payment will be made through secure, traceable methods

• Compare valuations if you are unsure about the first offer

• Choose centres with a verifiable service record rather than newly opened outlets

These steps give you the confidence to make an informed decision and help prevent miscommunication during the process.

Tracking Gold Prices and Market Trends

Gold prices move in response to international factors such as currency strength, global demand, geopolitical activity and economic sentiment. Tracking these changes helps sellers understand whether the current market supports a favourable price. Comparing multiple sources such as international spot rates and local retail prices gives a clearer picture of how much value you can expect.

Being aware of trends also helps you recognise unusually high or low offers from buyers. When a price is significantly different from the market average, it is essential to investigate further rather than rushing into the transaction.

Is Now the Right Time to Sell

Timing plays a significant role in determining the value you receive. When prices rise steadily, selling may offer stronger returns. In uncertain markets, converting gold into liquid funds can support urgent financial needs. The right moment depends on your personal priorities and how the market is moving.

Reliable centres like Value Gold help sellers understand both the valuation and the broader market context. With clear information, sellers can choose a moment that aligns with both market movement and financial goals.

Final Thoughts

Selling gold becomes a secure experience when the buyer is verified, the process is transparent and the valuation is supported by technology. Recognising early risks, understanding market conditions and following essential safety practices ensures that your gold is valued fairly, accurately and confidently.